Pension tax relief – how it works and how it can boost your retirement

Contributions play a vital role in building your retirement nest egg, as they increase the overall amount of funds available to you and allow for further investment in the stock market, which could potentially generate returns over several decades.

Basic-rate taxpayers receive pension tax relief automatically, while higher earners need to make a claim to obtain the complete benefit, otherwise they may miss out on substantial amounts.

between 2016 and 2021.

Make the most of 'free money' to enhance your retirement savings:

To boost your pension, consider the following financial strategies:

1. Claim tax relief: Ensure you're receiving the maximum tax relief available on your pension contributions. In the UK, this can add a significant percentage to your contribution, depending on your income tax rate. For example, if you're a basic-rate taxpayer, every £80 you pay into a personal pension will be topped up by £20 by HM Revenue & Customs, leaving you with a total contribution of £100.

2. Utilise your annual allowance: Even if you've already contributed to a pension this year, you may be able to utilise your annual allowance again if you've left an existing pension with a provider that charges high fees. Moving your pension to a lower-cost alternative could result in you being able to contribute more each year.

3. Stay within annual pension limits: As a general rule, Individual Savings Account (ISA) allowance should be used to save for retirement, rather than using your pension allowance. This is because ISAs are tax-free and may offer better returns than pensions.

4. Make use of tax-free dividends: Those with eligible income from Self-Assessment, such as freelancers and partners in partnerships, may be able to utilise the dividend allowance when making pension contributions. This could result in significant tax savings.

5. Check for inheritance tax benefits: Increasing your pension contributions could reduce your inheritance tax liability. The more you contribute, the less your estate will be liable to pay upon your death.

6. Review and re-opt in for ‘relief at 40’: Once your income exceeds £120,000, you'll start losing tax relief on your pension contributions, unless you pay an additional 40% income tax. This sometimes occurs unexpectedly when people are pension-age, having previously been in a higher tax band due to less income and without realising the 40% threshold.

7. Check for personal pension carrier schemes and bonus structures: Many employers offer company pensions with substantial bonuses for contributing at given targets. Your professional judgement would ultimately be the key in this determination.

- You're asking about pension tax relief, are you?

- I've been wondering about pension tax relief.

-

Claiming Tax Relief on Pension Contributions: A Straightforward Guide

Do you want to know how to claim tax relief on your pension contributions? If so, you're in the right place.

Tax relief on pension contributions is a fundamental aspect of saving for your retirement, and understanding it can help you make the most of your pension savings. Here's a simple guide to claiming tax relief on your pension contributions.

What is tax relief on pension contributions?

Tax relief on pension contributions is a government incentive programme designed to encourage individuals to save for their retirement. When you contribute to a pension scheme, the government contributes a share of the sum to your pension pot, either directly or by reducing the amount of tax you pay.

How does tax relief work?

Here's how tax relief works on a basic level:

1. You pay a certain amount of money into your pension pot each month.

2. The government contributes a portion of this amount, based on your tax rate, directly to your pension pot.

3. The total value of your pension pot increases as a result, helping you build up a sizeable nest egg over time.

What types of tax relief are available?

Different types of tax relief on pension contributions are available, depending on your individual circumstances. The standard tax relief rate is 20% and is applicable to basic rate taxpayers. Higher rate taxpayers can claim a 40% tax relief on any additional contributions.

Can I claim tax relief on my pension contributions if I'm self-employed?

If you're self-employed, you can claim tax relief on your pension contributions as a deduction from your taxable income. If you're not using a tax professional, it's essential to claim tax relief on your pension contributions as soon as possible to avoid any potential delays.

How can I claim tax relief on my pension contributions?

To claim tax relief on your pension contributions, you'll need to follow these simple steps:

1. Make a pension contribution.

2. Complete the relevant sections on your Self Assessment tax return, depending on your income tax rate.

3. If you're receiving any tax credits, consider informing HMRC whether your tax relief has been overpaid to avoid any tax credits being reduced.

By following these simple steps and understanding how tax relief on pension contributions works, you can maximise your retirement savings and create a secure financial future for yourself. - Are there any restrictions on the amount of tax relief I can claim?

- Pension tax relief FAQs

"What are pension tax benefits?

HMRC essentially "repays" part of the income tax you'd have paid on pension contributions by adding it directly to your pension fund. This is one of the ways to incentivise individuals to save for their retirement.

It can provide a notable addition to your pension savings. For instance, every £100 that a basic-rate taxpayer pays into a pension from their income only costs them £80, as HMRC "gives back" the 20%, or £20, that would normally be charged in income tax.

Additionally, they may also benefit from pension tax relief at their marginal rate, meaning a £100 contribution would cost each of them only £60 or £55 respectively.

Pension contributions receive tax relief up to the point of age 75.

How does pension tax relief work?

The tax relief operates in a distinct manner, depending on how your pension contributions are paid - either through net pay or relief at source.

Net pay

This person will usually be paid normally as soon as they've finished the work, based on the money they earn.

In this instance, your payments can be made before you are taxed (it might be part of a salary sacrifice scheme). This has the effect of giving you the tax benefit by reducing your earnings, leaving less income for HMRC to tax.

Relief at source

Occasionally, a workplace pension scheme – demands the basic-rate relief on your behalf and forwards it to your fund.

This is especially advantageous for individuals whose earnings fall short of the personal tax exclusion, meaning they don't pay tax. A lower earner who isn't taxed can still benefit from the basic-rate of pension relief on the first £2,880 paid into a pension each year.

For those contributing via this method, your pension provider will claim back £20 from the government if you pay basic-rate tax and contribute £80. This brings your overall contribution to £100.

If you reside in Scotland and pay the basic income tax rate of 19pc, or the lower rate of 20pc, you'll qualify for the standard 20pc tax relief on your pension contributions. Those paying 19pc won't need to make up the difference with tax.

The example shown in the table from MoneyHelper illustrates how the two methods provide the same level of tax relief for a basic-rate taxpayer.

Higher-rate taxpayers

You're eligible for pension tax relief at the same rate as your income tax, whether it's at 40% or 45%. This applies whether you have a net pay scheme or have the tax relief taken at source.

Claiming Relief on Pension Contributions

You may be eligible to claim tax relief on your pension contributions. This can greatly reduce the overall cost of contributing to your pension.

You can claim tax relief under the following options:

1. "Pay As You Earn (PAYE) and your employer deducts the contribution directly"

2. "Pay for it out of your pre-tax income and claim back the basic rate"

3. "You can also make a non-cesspit flexible individual contribution through your employer"

You might be able to claim tax relief on your pension contributions, but unfortunately, others may need to take the necessary steps to do so themselves.

The 20 percent of your pension contributions that qualifies for tax relief will be processed automatically for you. If your pension scheme deducts relief at source, your provider will claim this from HMRC, adding it to your pension fund. If your scheme is based on net pay, no further action is required as you will have already benefited from the relief by not paying tax on that portion of your income.

Higher-rate payers who aren't in a net pay arrangement must claim 20% or 25% tax relief themselves, unless they're self-employed and submit this on their tax return. Those who aren't self-assessing can also complete a tax return or contact HMRC directly. This needs to be done annually.

To do this on a tax return, head to the "tax reliefs" section, then click on "Payments to registered pension schemes where basic-rate tax relief will be applied by your pension provider."

This funding could either be seen as a refund to you, potential tax savings or a reduction in the amount of tax you have to pay.

I'm assuming you want me to paraphrase from the original text to give me something to paraphrase.

Please provide the original text.

It's worth noting, claiming unused benefits could be positively impacting your pension, enabling it to grow substantially, thus enhancing your retirement prospects.

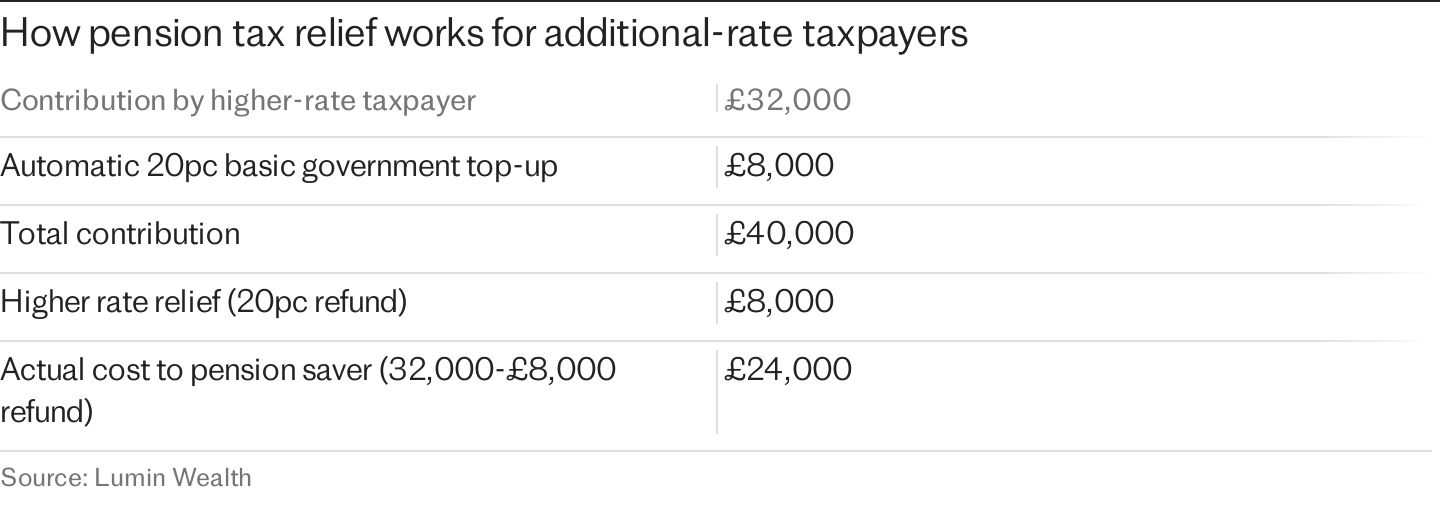

For instance, if a higher-rate taxpayer puts in £32,000 in a year, they will inherently get £8,000 of pension tax relief at the basic rate, increasing their contribution to £40,000, which can then be invested in the stock market.

As a result, they are entitled to an extra 20% in tax relief, taking their total refund from HMRC to £8,000. So, in effect, the actual cost of paying £40,000 into their pension was £24,000. This information is summarised as follows:

"Failing to make a claim can lead to losing out on considerable sums of money each year," stated James Corcoran, a senior chartered financial advisor at Lumin Wealth.

Is there a cap on the amount of tax relief I'm eligible for?

With annual fees being a maximum of £60,000 or one hundred per cent of your salary, whichever is the lower.

You'll not receive any tax relief if you contribute more than your allowance, and you'll also be taxed on the excess at your marginal rate. This allowance applies to all of your pensions, so contributing to multiple pensions will consume a total value equal to their combined effort - for instance, £10,000 in one pension and £10,000 in another will use up £20,000. Employer contributions and any tax relief also go towards this total.

Although an individual with a higher income can "carry forward" unused allowances from the previous three tax years' entitlement.

Pension tax relief FAQs

Still got questions about pension tax relief? We've got the answers to some of the frequently asked ones about how it all works.

How far back can I claim tax relief on my pension contributions?

Tax relief is available for pension savers on contributions made in the past three tax years.

This enables you to make the most of any unused annual allowance and receive tax relief on your pension contributions.

The annual allowance for pension contributions was £40,000 during the 2021-22 and 2022-23 periods, and it rose to £60,000 for 2023-24. This year's allowance remains at the same level. This means you could pay up to £240,000 into a pension before April 6, 2025.

Please be aware of another important limitation.

You can only contribute up to your "pensionable earnings" in a given year, which means you'd need to earn at least £200,000 as part of your yearly salary in order to pay in that amount.

It can be straightforward for those juggling work and family commitments to overlook these rules, so Mr Corcoran suggests seeking advice from a financial planner to guarantee you're claiming all the benefits allowed towards your retirement savings.

Calculating Tax Relief on Pension Contributions

To decipher the amount of tax relief on your pension contributions, consider the following steps:

1. **Understand what tax relief is**: Tax relief is a reduction of income tax from your annual allowance, allowing you to invest more in your pension, potentially with reduced tax liabilities.

2. **Check your pension type**: You can claim tax relief on your pension contributions if you're a UK resident, including those with a state pension, personal pension, defined benefit scheme, or stakeholder pension.

3. **Check the contributing amounts and rates**: Tax relief is based on your net earnings. For the 2022/2023 tax year, everyone gets tax relief at their marginal rate (i.e., the rate on your last £1 earnings), up to £3,600 for eligible employees' contributions or people who have reached the Clark's threshold, or up to £4,192 if you have basic-rate tax relief, which applies to annual allowances.

4. **Individual Savings Area (ISA)**: Although not directly related to tax relief on contributions, it's worth noting that you can put a portion of your income into several ISAs, and some allowance options allowing you to tax-efficiently supplement your investments.

You may need to repay some or all of your student loan if your income in the tax year reaches the threshold of £27,668 or more, depending on your award and when you received it.

You'll find how much you put into your pension demonstrated on your payslips, so you'll need to figure out the total amount you contributed throughout the tax year. It's crucial to also take into account the basic-rate of tax relief you received in your total contribution.

HMRC will therefore calculate the additional higher rate pension relief due, taking into account whether the individual is a higher or additional rate taxpayer and is due a 20% or 25% refund.

If you submit a claim for every year where you're due a refund, it might actually be simpler and quicker to just complete a Self Assessment form instead.

"Precise records of contributions and relief claimed are crucial for keeping on top of tax matters and long-term financial planning, especially bearing in mind how contribution limits affect your eligibility for tax relief", said Becky O'Connor, director of public affairs at PensionBee.

Challenge yourself with The Telegraph's exceptional range of Puzzles - and wake up feeling more refreshed every day. Improve your mind and elevate your mood with PlusWord, the Mini Crossword, the formidable Killer Sudoku, and even the traditional Cryptic Crossword.

Post a Comment for "Pension tax relief – how it works and how it can boost your retirement"