Reeves urged to let millennials raid their state pension early

Shadow Rachel Reeves has been advised to permit millennials to access their state pension earlier in their lives to help them afford buying their own home.

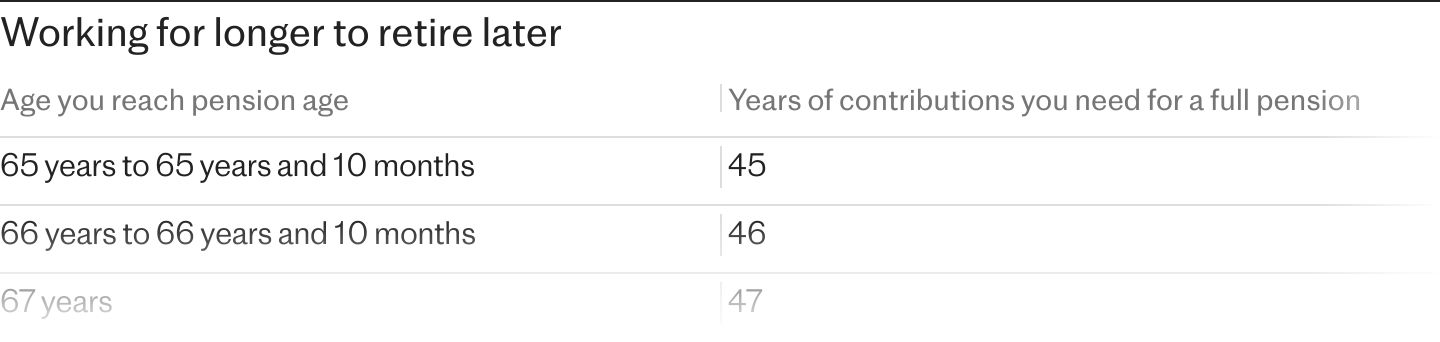

Andrew Lewin, the Labour MP for Welwyn Hatfield, is advocating for a plan that would give individuals under 40 over £11,500 if they agree to postpone their retirement by a year, provided they have ten years' worth of National Insurance contributions.

They warned that it might prompt some people to "waste" public funds and would be expensive to put into action.

among younger people.

For millions of people, the prospect of buying a home, switching careers, or starting a family hangs in the balance largely on the amount of financial assistance they can expect from their parents.

I'm eager to be an active participant in the discussion on how we can increase opportunities for those who are not able to rely on financial support from their parents to get ahead in life.

He suggested: "The proposal is to enable those who have worked for 10 years to take a year's worth of their state pension before their due date. I am aware that £11,500 could make a significant difference for many individuals who have built their careers, but require financial support at a critical juncture in their lives."

There is no text for me to paraphrase. Please provide the text you would like me to paraphrase in the style of United Kingdom English, and I will assist you accordingly.

Legal costs and renovation expenses, an analysis by property website Zoopla discovered late last year.

Theo Bertram, from the Social Market Foundation think tank, stated that allowing younger individuals to withdraw from their pension would be “a novel method to grant them the means to invest in their future during a pivotal stage in their lives”.

He commented, "What sets this suggestion apart and makes it so appealing is that you essentially borrow from your future self, rather than receiving a free gift."

However, financial experts expressed reservations about the proposed plan. Helen Morrissey, of Hargreaves Lansdown, noted: “We must ensure that in tackling current financial difficulties, we don't inadvertently create further problems for the future.”

“The possibility of accessing a full year’s worth of state pension ahead of schedule could potentially have a significant influence on people's ability to achieve financial objectives such as securing a place on the property ladder in the UK.”

“We face a difficulty in that we can't predict what the future will bring and, taking into account the present average for healthy life expectancy being around the early sixties, individuals may find themselves having to leave work at 61 or 62, only to then wait until at least 68 for the state pension to become payable.”

She noted, "The idea seems wonderfully intricate to manage and poses the risk of further muddling an already intricate system. Additionally, it could end up being very costly if people rush in to take advantage of it, which would only add to the difficulties."

Jason Hollands, of Evelyn Partners, stated: "At first glance, this proposed concept seems quite intriguing, however, it prompts concerns regarding the affordability and what prerequisites may be applicable to those looking to take advantage of such a provision."

Initially, this is an unpriced proposal which could lead to a rise in claims for financial support from those who are due it. At a time when the public finances are in a very bad state and the tax rate is significantly higher than it should be, such a policy could pose a significant risk to the public purse.

Moreover, as an example, this sum could be used for purchasing a property, but I remain concerned that people claiming this £11,500 might not utilise the money judiciously and could, conceivably, squander it, since this is, in essence, public money, not a separate fund for their retirement.

I accept that young people have many difficulties dealing with student debt and owning a home, but I do have concerns that their current pressures may not only persist but even escalate in the long run.

Enhance your mental clarity and lift your mood each day with The Telegraph's exceptional collection of Puzzles. Improve your cognitive function and mood with PlusWord, the Mini Crossword, challenging Killer Sudoku, and the traditional Cryptic Crossword.

Post a Comment for "Reeves urged to let millennials raid their state pension early"